In this report, we present a data-driven look at the changes to the US escape room industry over the past year, and put it in context with shifts over more than a decade.

Headline: The number of escape room facilities in the US has remained stable over the past 3.5 years, but there are a few underlying trends of note. The first is consolidation of ownership. The second is an expansion of immersive gaming business models. This report will explore these trends in depth.

And in season 10, episode 13 of Reality Escape Pod, you can listen to us discuss the trends explored below.

This report is produced by Room Escape Artist in collaboration with Morty – an app to find, book, and rate every escape room in the world. Players can get rewards by booking their next game with Morty’s built-in loyalty program, MortyPass, and owners can get 2x more bookings by signing up.

The underlying data includes the 11 years of data collected and maintained through the Room Escape Artist Escape Room Directory, and builds on years of tracking and reporting on the industry. This year’s report presents the same REA-collected data with additional material powered by Morty’s extensive industry data set.

Disclosure: We have a long-standing relationship with Morty, with David functioning as an advisor, and us owning a tiny stake in the company.

2025 Year-End Industry Numbers

In December 2025, there were just over 2,000 escape room facilities in the United States.

This count of escape room facilities is consistent with the 2024 industry report and the 2023 industry report. The industry is stable, but it is shifting.

As with previously published reports, it is critical to note that the number of facilities does not alone indicate the size of the industry. It is one indicator, and the one that Room Escape Artist has the data to measure longitudinally over 10+ years.

Through our collaboration with Morty, the later section of this report will look at some new metrics, including revenue.

Historical Industry Numbers

We’ve been covering the US escape room industry since 2014. Here’s where we’ve been:

- In 2014, there were about 2 dozen escape room facilities.

- The industry experienced huge early growth: 317% growth in 2015, followed by 800% growth in 2016.

- By 2019, pre-pandemic, growth had leveled off to just 2%.

- During the pandemic, the industry shrank: 4.3% decrease through mid 2020, followed by a 7.5% decrease over the following 6 months through early 2021.

- By mid 2022, the industry had stabilized at the current facility count.

- Based on counting escape room facilities, the industry has remained stable through 2023, 2024, and 2025.

This US escape room industry has endured for 11 years. It is not a fad. It had a boom and a bust, exacerbated by the pandemic, but it has stabilized.

However, that’s just the surface-level view. The following deep dive into trends from these stable years shows how the modern industry is changing.

Counting Escape Rooms

Facilities

The Room Escape Artist data anchors to escape room facilities. These are permanent physical locations where you can play real-life escape rooms in person. One business owner might operate 10 locations around the country or 2 locations in the same city. These would be counted as 10 facilities and 2 facilities, respectively. A location with more than one game counts as one facility. The industry numbers above are in reference to escape room facilities.

Over the past few years, we’ve expanded our definition of an escape room facility beyond the traditional brick-and-mortar escape room to include overnight escape room experiences in Airbnbs and challenge arcades.

Of note, our definition excludes facilities that exclusively host outdoor games, VR games, tabletop games, or mobile (pop-up, trailer, or similar) games. For more details on how we count escape rooms, see the final section of the report, titled Appendix: Details on Escape Room Facility Counting.

Games

Morty also counts the individual games that are available across these facilities. In December 2025, there were approximately 7,800 escape rooms available to play in the U.S. This includes physically built, in-person escape rooms. (See our definition, above.)

According to Morty’s count of games and facilities, each facility holds an average of 3.8 individual games.

While we don’t have historical data tracking this ratio, we believe that this is a higher average games per facility than in the past. Over time, we expect this to creep upwards, as facilities are more likely to add games without closing older games.

Companies

According to Morty, there are 1,450 escape room “companies” in the US.

For this count, an escape room “company” includes one or more connected facilities. These connected facilities could all be part of the same chain or franchise. They could also be just two facilities with the same name and branding. This number is an approximate count of the business entities or owners across all the escape room facilities in the US.

Podcast: Reality Escape Pod

On Reality Escape Pod, co-hosts David Spira and Peih-Gee Law (Survivor) explore immersive gaming from all angles, with guests who have incredible experience in this realm. Season 10 included Will Shortz, Puzzle Master at the New York Times, Jonathan Driscoll and Sacha St. Denis of Escaparium, creators of the #1 ranked escape room in the world, and legendary Disney Imagineer Doris Hardoon.

On the last episode of Season 10 (releasing tonight!), I talk about all the data in this report. If you want to hear deeper analysis of this data, listen on REPOD.

Consolidation of Escape Room Companies

In the past year, we’ve seen a consolidation of escape room companies, meaning that the same number of escape room facilities are owned by fewer people, or fewer corporate entities.

Although you can’t see this information in the Room Escape Artist directory, we track affiliated facilities. For example, there are 90 affiliated locations named Escapology (see below). And, for another less obvious example, the two locations of Encrypted Escape in West Reading, PA, and Bethesda, MD, are owned by the same people as the two locations of Captured LV Escape Room in Allentown, PA, and Bethlehem, PA.

This data is difficult to track. Sometimes multiple facilities are under the same ownership, but if the names, branding, and URLs are all different, then we might not have any way to know the facilities are connected.

Decrease in Single-Facility Companies

According to Room Escape Artist’s tracking, 57% of escape room facilities in the US are single-facility companies. This has decreased significantly over the past 4 years.

| Year | Percentage of Total Escape Room Companies that are Single-Facility Companies |

| 2025 | 57% |

| 2024 | 59% |

| 2023 | 63% |

| 2022 | 66% |

This is an inevitable trend, fueled by a number of factors including the growth of chains and franchises, buyouts and consolidation, and the closure of failed single-facility companies.

Increase in 2-Facility Companies

A significant driver of consolidation that emerged this year was the expansion of companies with exactly 2 facilities.

This metric is 🆕 in the chart below because it wasn’t previously remarkable. While we saw a huge growth in companies with more than 2 facilities last year, the count of companies with more than 2 facilities is almost unchanged this year.

| Number of Facilities | Number of Companies |

| More than 10 | 11 (⬆️ 1) |

| More than 5 | 20 (⬇️ 2) |

| More than 2 | 85 (⬇️ 3) |

| More than 1 | 192 🆕 |

This is also driving the decrease in single-facility companies shown in the single-facility chart above. Whereas most companies were individually owned when this industry started more than 10 years ago, we are trending toward single-facility companies comprising only half of businesses in the near future.

The large chains and franchises with many facilities (see below) continue to account for a lot of the ownership consolidation, but venues with just 2 facilities are also now playing a large role.

The Largest Chains & Franchises

According to Room Escape Artist, the companies with more than 15 facilities are:

| Escape Room Company (Chain or Franchise) | Count of Facilities |

| Escapology | 90 (⬆️ 14) |

| The Escape Game* | 52 (⬆️ 5) |

| Activate** | 48 (⬆️ 20) |

| Breakout Games** | 32 (no change) |

| Escape The Room | 21 (⬇️ 1) |

| Red Door Escape Room | 20 (⬆️ 1) |

| All In Adventures | 20 (⬇️ 1) |

| PanIQ Entertainment | 18 (⬇️ 1) |

| The Great Escape Room | 17 (⬇️ 2) |

Escapology has the most facilities, and expanded significantly in 2025.

The Escape Game has the second most facilities, and expanded modestly in 2025.

Activate leapt into the third spot, with huge expansion in 2025. Activate isn’t, strictly speaking, an escape room. It’s a Challenge Arcade. We talked about the proliferation of Challenge Arcades (and explained the concept) in our 2023 industry report.

The rest of the companies rounding out this list remained stable, adding or dropping just 1-2 locations, or none at all.

*The Escape Game also owns Great Big Game Show, many of which are colocated with The Escape Game locations. We have not tracked Great Big Game Show locations in the Room Escape Artist directory, so they are not counted in this report. However, according to their website, they are approaching 2 dozen such locations, including those that are announced but not yet open.

**Activate and Breakout Games are both owned by Sounds Fun Entertainment.

Escape Room Adjacent

After 11 years of following this industry, it is still hard to define what, exactly, an escape room is.

In our opinion, this is a feature (and not a bug!) of this entertainment medium. The original concept of an escape room was infinitely adaptable. Creators infused their expertise from related industries and grew the universe of what an “escape room” could be. The format has morphed from “escaping a room” into different forms of real-life, collaborative, immersive games with all sorts of missions and constraints, different scales of environments, and, at times, deep characters and storytelling. For over a decade, creators have continued to push the boundaries of the medium.

That said, for the directory we had to draw some boundaries. Room Escape Artist’s directory excludes facilities that only offer VR experiences, outdoor walking experiences, or mobile experiences that come on site to different locations. Our directory also excludes facilities that only offer game shows (such as The Escape Game’s aforementioned Great Big Game Show), which is adjacent, but more distant. However, many of the facilities in our directory offer these other types of experiences in addition to site-specific, in-person escape rooms.

Adjacent Expansion

In 2025, we’ve seen the growth of the different business models that we’ve highlighted in recent industry reports. The chart below looks at the different types of facilities we explicitly label in the Room Escape Artist directory, all of which expanded this year.

| Game Type | Count of Facilities |

| Challenge Arcade | 71 (⬆️ 47% YoY) |

| Family Entertainment Center (FEC) with escape rooms | 35 (⬆️ 26% YoY) |

| Overnight (i.e. AirBnB escape rooms) | 17 (⬆️ 23% YoY) |

The year-over-year growth is impressive, especially for Challenge Arcades (driven by new Activate locations), but the numbers are still small.

In 2024, these non-traditional venues made up 4% of the facilities in the Room Escape Artist directory. In 2025, they account for 6% of the facilities.

Stable but Shifting

This is a trend we are watching.

The industry is stable, but not entirely the same as it once was. It appears to be shifting toward more adjacent business models (that are arguably not escape rooms, depending on who you ask) rather than more traditional escape room operations.

We don’t yet know whether adjacent styles of immersive gaming will boom and bust, or whether they will be an ever increasing segment of our directory, perhaps with the range of styles continuing to increase. If the count of facilities remains stable, but more of the facilities operate a different business model, then we’ll be losing traditional brick-and-mortar escape rooms.

At this point in time, it’s not significant enough to say this is definitely the case, but it could be the start of a fundamental shift in the nature of the escape room industry.

Convention: RECON Laval 2026

The Reality Escape Convention, or RECON, is an escape room and immersive gaming convention for industry professionals and players. It’s for those who believe in the future of this industry and want to shape where it goes. RECON 26 will be in Laval, Québec, Canada on August 16-17, 2026.

RECON is the best place to learn about how the industry is changing. The speaker sessions and discussion groups will deep dive into many of the trends in this report. And if you want to meet the people who are driving some of the trends in this report, you’ll find them at RECON.

🎁 Use code REA50 to get $50 off a RECON 26 General Ticket. (This holiday coupon code expires on December 31, 2025.)

New Facilities & Closures

The count of escape room facilities in the United States has remained stable in 2025. The number of new facilities offset the number of closures. Additionally, compared to last year, we witnessed more stability, meaning both fewer new facilities and fewer closures.

Closures

We started tracking closures and removing escape room facilities from our directory in 2017. If we look at the total facility closures over time, we see that the closures decreased in 2025. In fact, 2024 looks more like an anomaly than a trend line.

| Year | Percent of Total Closed |

| 2017 | 3.95% |

| 2018 | 14.41% |

| 2019 | 16.86% |

| 2020 | 16.06% |

| 2021 | 12.22% |

| 2022 | 9.07% |

| 2023 | 8.11% |

| 2024 | 10.46% |

| 2025 | 8.86% |

In total, since we started this directory, 48% of the escape room facilities we’ve added have closed and been removed from the directory. That number sounds high, but as we talked about in the 2024 industry report, this is pretty healthy in the context of small businesses overall, and in the more than 10 years of the escape room industry.

For the past many years, we’ve been predicting that this closure rate will shoot up. We’ve come to realize that this apocalypse of closures is happening, but not in the way we expected. It’s not resulting in a dramatic loss of facilities. Rather, it’s resulting in consolidation (see above). Escape room owners are closing up shop by selling their assets and turning over their leases to an existing escape room company.

Opens

We added fewer than 200 new facilities to our directory in 2025. This is fewer than in previous years, but enough to keep the industry unchanged in terms of facilities count.

20% of those new facilities were members of the biggest chains and franchises (see above). The rest were independent or affiliated with smaller companies.

Escape Immerse Explore Orlando 2026

Our Escape Immerse Explore escape room tours take escape room players to some of the world’s best escape room markets, including Montreal, Albuquerque, San Francisco, and the Netherlands. You’ll experience a variety of escape room styles, go behind the scenes with creators, and make life-long friends.

There are still tickets available to Escape Immerse Explore Orlando. This will be our first 4-day tour in North America: Sunday, April 12 – Wednesday, April 15, 2026.

In addition to playing the top escape rooms in Orlando, this Tour will take you to Clearwater and Port Charlotte, cities on Florida’s west coast that are also home to award-winning escape rooms that can be hard to get to… but we’ll have a bus!

This tour visits an impressive 7 Golden Lock Award-winning games, plus new 2025 TERPECA winner Cornstalkers at The Escape Ventures and brand new Doldrick’s game Galactic Beef: The Cosmic Adventures of Star Cow (reviews coming soon!)

Revenue

Estimated average annual revenue for the US escape room industry: $300M

Based on Morty Trends (a tool which observes industry signals across the US market) there are about 40,000 bookings per week on average in the US. Based on an average of $150 per bookings, this is an annual revenue of about $300M.

This is our first look at this number, in December 2025, so we can’t say how this is trending year over year.

Bookings

Popular Booking Times

Morty’s data also shows how often different time slots are booked. Darker blocks are more often booked. Lighter cells are less often booked.

This heat map is an average across the entire United States, which is not one uniform market. On average, we can see that Friday night through Sunday afternoon are peak booking times, but that may not be true for any given city.

This data suggests that escape room businesses close on Tuesday rather than the more popular Monday. Being closed on Monday makes sense in some cities, especially if nearby other businesses, such as restaurants, aren’t open. However, if you are getting any tourist traffic, opening on Monday is an opportunity to take bookings from customers on a long or extended weekend away in your city.

Booking Systems

Escape room facilities use a variety of booking systems.

Based on Morty’s data, this table shows what percentage of escape room facilities use each booking system in December 2025. Of note, this is based on facilities, not companies, and as we saw above, the average number of facilities that are part of the same company is growing. Booking systems tend to be uniform across a single company, though this is not always the case.

Note that “all other booking systems” accounts for 17% of escape room facilities. That means there are a lot of other players, and no one system is dominating.

This report does not assess the quality of any given booking system, or its ability to support the needs of escape room venues.

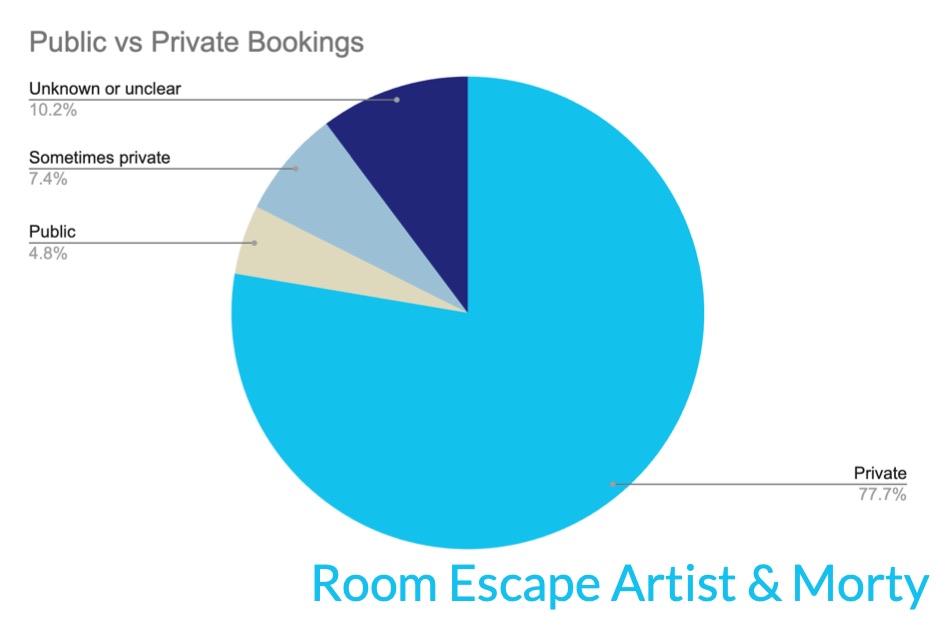

Public vs Private Bookings

The United States has a reputation for having public bookings, stemming from the first escape rooms that opened in 2013 and 2014. In 2017, when public booking was still broadly used, we published An Exploration of Escape Room Pricing Structures. We concluded that “if your room escapes are designed for 2-7 players, we recommend private ticketing,” which applies to the majority of escape rooms.

At the end of 2025, we see that this is largely how the market has shifted. Based on Morty’s data, only 12% of escape rooms are public or only “sometimes private” while 78% are always private. The “sometimes private” designation combines cases where only certain time slots are private, an additional fee may be added to play privately, or similarly variable cases. (For clarity, these percentages are in reference to individual escape rooms and not in reference to facilities that might have multiple games, occasionally not all booked the same way.)

While the global perception remains that Americans commonly play escape rooms with strangers, the shift to private booking was already happening pre-pandemic, and the pandemic only accelerated this. By 2025, the majority of US escape rooms are played privately.

Patreon Membership

If you are here, at the end of this report, please consider supporting us on Patreon. The financial support we receive through Patreon is our operating budget. It supports the research, reporting, writing, and editing behind this website. Without your support, we would not be able to produce this industry report.

You can support us for as low as $2 per month (and an annual membership gives you a 10% discount!) That membership gets you access to our Patreon supporters Discord channel where there is interesting and entertaining escape room chatter almost every day. We get reactions to new ideas in that channel. Plus the wonderful folks there ask and answer business questions, offer game recommendations, and so much more. We’d love for you to be a part of it.

And to those of you who already support us on Patreon, thank you so much!

Conclusions

Consolidation of Ownership

In 2025, we saw an increase in escape room consolidation, both big and small. Single-facility companies make up only 57% of all US escape room facilities in December 2025.

A big driver of consolidation was the increase in companies with just two facilities. Instead of escape room facilities simply closing their doors, they frequently sell their assets to another company, often a company with just one other location. Businesses are closing, but in this way, it’s not resulting in a massive retraction in the total number of escape room facilities in the country.

The large chains and franchises are also opening more locations, with growth driven largely by Escapology, The Escape Game, and Activate.

Shifted Toward More Diversity of Experience

Over the past few years, we’ve added new categories of games to our directory including family entertainment centers (FECs) with escape rooms, overnight escape room experiences in Airbnbs, and challenge arcades. All of these categories are growing – and in the case of the Airbnbs, this is growing despite the fact that Airbnb has done a terrible job of supporting this growing niche.

We’re paying attention to this trend. We don’t know how long these Airbnb hosts will be able to or want to maintain the games. We don’t know when Challenge Arcades will be saturated. It’s also possible these escape room adjacent business models will be an ever-growing sector of the escape room market. We’ll watch as the market shifts and continue to report on the changes.

Although we haven’t tracked game shows specifically in the Room Escape Artist directory, anecdotally, we’re seeing them pop up inside escape room facilities and as standalone experiences. Morty confirms that this category grew in 2025. We don’t know if these will have the same staying power as escape rooms, but we’ll continue to watch this trend as well.

We are excited about diversified experiences, which we think have the capacity to bring in more first-time players. We expect that many players who discover and enjoy challenge arcades, for example, are likely to seek out similar experiences such as escape rooms.

As with all experiences and all products, quality matters. As long as these escape room adjacent experiences are high quality, they will support industry growth, and likely receive support from the existing fanbase.

Pushing Boundaries

Beyond the format breakers like challenge arcades and overnight experiences, this year we’ve seen traditional brick-and-mortar experiences experiment with the standard escape room format, to great effect.

One such example is pipelined games. In a pipelined game, multiple teams are able to play at the same time, with some offset. Each team moves linearly through the game space, and after enough time has elapsed and one team has sufficiently progressed, the next team starts playing the same game from the start, while the previous team is still in the space.

This model is used by top-tier companies like Escaparium in Laval, Canada, creator of the top-ranked game in the world, Magnifico. In order to stretch their experiences longer and tell more complete stories while improving their business model, their more recent games builds (including Magnifico) are pipelined.

Pipelining can benefit standard 60-minute experiences at well. The Dreams at 4 Dreams Escape Game in Austin, Texas, is a pipelined 60-minute escape room. This model allows a business to run more games in the same amount of time.

Not every escape room company needs a pipelined business model today. It shouldn’t be everyone’s goal. However, when a company reaches a point where they are filling up their peak Friday, Saturday, and Sunday bookings, pipelining is by far the best way to extend those peak days. It’s a format iteration that continues to extend the possibilities for this industry.

Impact of The Largest Chains & Franchises

As we’ve said in past reports, a threat to this industry is first time players stumbling into a not-so-great escape room and writing off escape rooms entirely.

With more facilities across more geographic locations, the large chains and franchises are increasingly reaching the uneducated consumer first. They tend to have more marketing power, with larger budgets to spend on ads. It is paramount that these companies deliver quality product, with quality customer experience. Quality control across multiple venues can be a big challenge.

We know from experience that some of largest chains and franchises care a lot about the experiences they provide, but that’s not universally true. Still, we are encouraged that of the big companies in the report that we did visit in 2025 (The Escape Game, Red Door Escape Room, and PanIQ Room), each offered a positive experience that we expect will encourage new entrants into this hobby.

It’s Time for Price Stratification

One similarity between both the Room Escape Artist and Morty user-bases is that, while both are frequently visited by diehard escape room players, the overwhelming majority of traffic to both platforms is coming from newbies. We are in an era where even largely disconnected consumers are seeking insider information to make their purchasing decisions. When people select a game, it is a vulnerable experience. They want their friends and family to like it. The inverse is also true; they do not want to be embarrassed by their choice. Even still, many consumers are making their purchasing decisions based on theme and vibes.

The Morty data showed an average of 3.8 escape rooms per venue, more than we’d been estimating. Given that venues tend to make new games without closing older ones, we would expect this average to increase over time.

Older games present a risk to the industry. The longer a game exists without significant improvements, the more wear and tear it takes from players. If these games aren’t iterated upon, they risk giving players a bad experience, and turning them away from both the company and escape rooms as a whole.

If a new player has a bad time playing your game, most will not think, “I didn’t like this game, I’ll try another.” Instead, they will think, “I don’t like escape rooms.”

Unfortunately, most companies do a poor job of communicating product quality and age to their customers. By far the best way to do this is with stratified pricing.

Companies with premium games need to stratify their pricing to educate the consumer. Price the older game lower. Even if it’s impeccably maintained, it’s likely to be lesser in other ways. Over time, a company often learns new skills and increases build budget. By showing customers a difference in the products available from a single company (and giving them a deal on the lesser one!) customers won’t necessarily judge an older game by the same metrics as a newer one.

Price stratification can help you court different types of consumers (i.e. budget vs premium shoppers) and minimize the risk of disappointing repeat customers.

Economic Forces

The politics of Room Escape Artist are the politics of escape rooms. Regardless of your political leanings (or ours, personally), the economy doesn’t feel great right now (Consumer Confidence Index December 2025), and that puts pressure on escape room businesses. We’ve been hearing from escape room owners around the country that sales are down.

There are a lot of factors – some national and many regional.

Tariffs and inflation have raised the prices of materials, increasing the costs of new builds and every day escape room maintenance. Tariffs and inflation have also increased the cost of living for consumers (USDA – Food Price Outlook, final update for 2025).

Leisure spend – such as escape rooms – is a luxury that a lot of consumers can’t afford, or worry they won’t be able to afford in the future. Escape rooms thrive when regular consumers feel confident spending their money. In some parts of the country, this year saw mass layoffs, exacerbating consumers pulling back on spending.

In some cities, escape rooms benefit heavily from tourism, but international tourism has declined (CRS-Insights Report), and domestic tourism is highly variable, depending on what is happening in a region. If your business is fed by tourism, especially international tourism, you’re likely feeling this pressure.

While escape rooms aren’t big enough for economists to study them, after reading about other industries, our expectation is that we’re in for a rough few years.

We hope this expectation is wrong. We’d be very happy if we are wrong, but as David’s macroeconomics professor Dr. Stanley once said, “No one needs the President to tell them how the economy is doing… they already know.”

The Growing Quality Gap

While not driven by a rigorous data analysis, we are seeing an ever-growing quality gap between the top of the market and mid-market. Facilities with well-regarded games within the community tend to be doing better. As a general trend, Morty sees that games with higher community scores are booked more often.

We know that a lot of companies are not thriving right now, and there are a lot of outside forces contributing to this. Through these times, we believe that better, more consumer-friendly product is the way forward. It means better ratings and more word-of-mouth marketing. Better products will create new habitual escape room consumers and new enthusiasts. It’s the way to reach those who are spending on leisure right now, and these folks do exist.

If you own a business in this industry, come to RECON Laval. This is a convention designed for you. The talks will be focused on actionable techniques – creative and business – that you can use to elevate the experiences you provide for your customers. This is how we grow as an industry. We come together to learn, share ideas, and innovate. If your business is not thriving in the way you’d like, is not renowned (or even noticed), and you feel like you don’t belong at RECON, let me assure you that you do. We have something designed into the RECON Laval experience just for you.

And here at Room Escape Artist, we’re sharing ideas every single day. We’ve been writing about this industry since 2014, and we’ve been publishing daily for almost 10 years.

Room Escape Artist Website

Room Escape Artist is your home for well researched, rational, and reasonably humorous immersive gaming content and events. There’s a whole team of people keeping this website up to date. If you’re new to Room Escape Artist, here are are a few sections you might want to check out:

- Regional Recommendations Guides – Find the best escape rooms in cities all over the world

- Golden Lock Award Winners – Read about our favorite escape rooms we reviewed in 2025

- Player Tips – Recommended gear, travel tips, and how to become a more adventurous player, among other tips

- Industry Commentary – Our room design and business sections offer a lot of inspiration.

Methodology & Past Reports

Following the publication of our first piece on the US industry growth in 2016, we published more detailed information on our methodology for tracking the growth of the industry. That piece includes a bit of history about our directory and additional perspectives on the data.

This is our 11th industry report. The previous studies will remain available:

- US Escape Room Industry Report – December 2024

- US Escape Room Industry Report – December 2023

- US Escape Room Industry Report – July 2022

- The Impact of the Pandemic on the Escape Room Market [Survey Results] (May 2021)

- US Escape Room Industry Report – 2020 Year End Update (February 2021)

- 6 Year US Escape Room Industry Report (August 2020)

- 5 Year US Escape Room Industry Report (August 2019)

- July 2018 Escape Room Industry Growth Study

- 2017 Escape Room Industry Growth Study

- 2016 Escape Room Industry Growth Study

Thank Yous

Melissa Miller manages the Room Escape Artist Escape Room Directory. She spends many, many hours throughout the year sifting through data and determining which companies have opened, closed, moved, or been acquired. We could not keep the directory running or produce this report without Melissa’s incredible attention to detail and remarkable diligence.

Thank you to Morty for sharing their data with us, and helping us create the most comprehensive industry report we’ve produced to date. We appreciate Morty’s partnership in tracking and analyzing the trends in this industry.

If you’re a player looking to find, book, or rate escape room or if you’re an owner looking to get more bookings, check out Morty.

Appendix: Details on Escape Room Facility Counting

Games

This majority of the data in this report references facilities, not games. While some facilities only operate a single game, many operate two or three games, and some operate far more. When the report references individual games, that is explicitly called out.

Soon to Open

The Room Escape Artist directory includes some facilities that are not yet open for business, but appear to be opening in the near future. To be listed in the directory, we require a facility to have their address published on their website*, and their website to tell us a bit about the business.

We do not include escape room facilities that might open some day. A social media page that says “coming soon” is not enough to be listed in the directory or counted in this report.

*Some of the overnight escape rooms, labeled [Overnight] in our directory, do not have a publicly listed address, due to the nature of booking websites like Airbnb.

Dates

All dates in our data are the date when we added a company to our directory or removed it from our directory. While we try to find companies as soon as they open, and check often for closures, our dates don’t necessarily reflect exactly when a facility opened or closed.

Permanence

Our directory only includes established entertainment facilities that continually operate physical escape rooms. We do not include escape rooms that appeared for a weekend, a week, or even a month, in a temporary structure or other facility, but will not operate continually. We include some facilities labeled [Seasonal] which are open permanently, but only at certain times of year.

Venue

Most escape room facilities are independent operations. Others operate out of larger entertainment venues such as bowling alleys, arcades, or restaurants. Many of these are labeled [Family Entertainment Center] in our directory. We include these as long as the escape room is a permanent fixture in the larger venue.

Mobile Facilities

The count of escape room facilities above does not include mobile escape room venues, which we stopped actively tracking in 2020. In early reports, mobile facilities were included within the Room Escape Artist US Escape Room Directory, and in the report. However, the current directory interface requires a full address and does not include mobile rooms, and because our mobile data is now outdated, it is not included here. The change to no longer count mobile facilities also accounts for a portion of the decrease in facilities in 2020.

![Wolf Escape Games – The Pharaoh’s Tomb [Hivemind Review]](https://roomescapeartist.com/wp-content/uploads/2025/12/wolf-escape-games-the-pharaohs-tomb-2.jpg)

![Red Door Escape Room San Mateo – Captain Maniacal’s Lair-bratorium [Review]](https://roomescapeartist.com/wp-content/uploads/2026/01/captain-maniacals-lair-bratorium-captain-maniacals-lair-bratorium-1.jpg)

![The Haven [Reaction]](https://roomescapeartist.com/wp-content/uploads/2026/02/the-haven-immersive-brookyln-1.jpg)

Leave a Reply