Editor’s Note: The original post starts with the Introduction by David Spira, but as this situation evolves, we will continue adding dated updates at the top of this post.

2/21/26 Update

What just happened?

A quick update on what is happening in tariffs news. You might have seen some headlines on Friday, Feb. 26 saying that the Supreme Court struck down the President’s tariffs. You may have then seen a flurry of follow up news that the President announced he was imposing a 10% global tariff and then 15%. This continues to be a rapidly changing situation, and no one really knows where it’s all going.

If you’re interested in additional background:

Exactly what is going on here gets into the nitty gritty of mechanisms for how the President is able to impose tariffs. I’m going to do my best to explain this high level, but again the caveat that I am not a lawyer and that this is complex / confusing.

Under the Constitution (always a great way to start a sentence), Congress holds the power of the purse, which means that Congress gets to set taxes. Congress is allowed to delegate this responsibility to the Executive Branch (i.e. the branch of government that is run by the President), and it has done so over the many decades of America’s existence through a variety of different laws. The law that the President used to impose most of the tariffs that have been announced over the last year was the International Emergency Economic Powers Act, or IEEPA (pronounced like eye-eepa). The Supreme Court ruling was basically that IEEPA does not actually allow the President to impose tariffs, so this was unconstitutional, and it all needs to be unwound.

Note that I said that IEEPA was used to impose most of the tariffs over the last year. Not all of the tariffs that were imposed were through IEEPA, and this ruling does not affect those tariffs (this includes tariffs on steel and aluminum, lumber, and automobiles). The follow up announcements about the 10% tariffs, which have now been bumped to 15%, is using a law called Section 122, which allows the President to impose tariffs up to 15% for 150 days, after which Congress would need to allow for a further extension. Section 122 has never been used before, so no one knows exactly how this will play out.

The best we can do is keep our eyes on the news and continue to build a lot of flexibility into all of our planning.

Introduction by David Spira

In December 2024, I advised a private client in my consultancy to buy all of the hardware, and then some, that we were going to need for an upcoming build, even though we didn’t yet know precisely what components were required. This recommendation ended up saving my client a ton of time and money.

Since then, my inbox has filled with stories from the owners and makers of escape rooms and immersive games telling me about shipping delays, extreme price spikes, and in some cases, an inability to purchase necessary components.

As these stories came in, Jacky Chang pitched me on blending her background in public policy and love of escape rooms to help investigate the places where escape rooms and politics collide, usually to the detriment of escape rooms (and small businesses in general.) The individual operators within our industry are not big enough to pay to play, but that doesn’t mean that our community isn’t affected by choices made in Washington.

This is Jacky’s first piece with Room Escape Artist, and it comes with a trigger warning: politics. The politics of Room Escape Artist are not about our individual personal politics, but the issues that encourage or discourage the growth, viability, or safety of escape rooms. Today we’re exploring tariffs; tomorrow, we may be digging into credit card policy and chargebacks.

Along the way, we ask that you check your partisanship at the door and join us as we explore specific issues. You won’t find the R-word, D-word, or T-word in this piece. Reasonable people can disagree, and we ask that you approach this as a reasonable person… even in 2026.

Tariffs are a fundamental issue for American escape room operators who are building new games or maintaining old ones. The goal of this piece is to help you understand how changes in tariff policy impact business.

Analysis by Jacky Chang

If you’re anything like me, recently you’ve been having a hard time figuring out what you can buy online, when it will get to you, and how much it’s going to cost. You might have seen various banners on websites recently declaring things like “tariffs included,” “duties not included,” “shipping to the U.S. resumed,” or “shipping to the U.S. suspended.” These banners might be changing week to week, and you’re trying to figure out if you can just wait this out, or terrified that things you need are going to suddenly spike in price. In this post, I’m going to do my best to explain what a tariff is, what is going on with tariffs, and what you, as a person who buys things online but has never thought about what country they come from before, can do to keep track of what’s going on and figure out what you should do.

Disclaimers

Before we dig into tariffs in depth, I want to add an upfront disclaimer that the language in this section is necessarily going to be somewhat academic and legalistic. This is because there unfortunately isn’t a way to explain this in regular language that doesn’t miss nuance/ possibly lead you astray, which will become quickly apparent as we go through this. Apologies for this, but also I did not create this world, we all just live here.

I will also be citing a number of cases and studies but will not be diving into their details. Links with more information will be in the footnotes in case you really hate yourself or can’t get to sleep tonight.

It’s also worth noting that current tariff policy is a constantly moving target, which as you’ll see, is part of the problem.

Lastly, I am neither a lawyer nor an economist. I am just a person who enjoys helping people understand complicated things that impact their lives.

We’re going to have to start off now with some definitions.

What are tariffs?

Let’s start with the basics. Tariffs are taxes imposed on foreign-made goods paid to the government of the home country of the importer. For the sake of this post, we’re going to focus on the United States as the home country, as the details of tariffs change significantly depending on what home country you’re discussing.

Tariffs only matter for “foreign-made” goods, and the tariffs themselves vary depending on both an item’s “country of origin” and product category. For example, as of the date of writing (Jan. 29, 2026), all aluminum, steel, and derivative goods imported from the UK have a 25% tariff applied to them, although there’s an agreement in place to lower this at some point.1 The baseline tariff with China is fluctuating and depends on the good, but according to one source as of November 2025 appears to be an average of 47.5% across all goods.2

Country of origin

So how do you determine what an item’s “country of origin” is? United States law does not define the country of origin as “where the item was shipped from,” “where its parts come from,” or even “where it was manufactured.” The law instead defines “country of origin” as the last country where “substantial transformation” occurred, and “substantial transformation” is defined as “the good underwent a fundamental change in form, appearance, nature, or character.” This test goes back to a Supreme Court decision from 1908 involving corks.3

If this seems like a weirdly philosophical definition that is not clear, intuitive, nor predictable, you are not alone. Many years of legal battles have helped spell out some of what this means, and some of these examples are useful in showing how messy this can be.4 For each of the below, does this count as a substantial transformation?

Attaching the handle to a brush head to create a brush5

Yes, brushes where the head was attached in the U.S. after the handle was imported from Japan were considered made in the U.S. and did not need to be marked as “Made in Japan”.

Attaching the upper part of a shoe to the soles6

No, shoes where the leather upper was made in Indonesia, imported into the U.S., and then attached to soles were still required to be marked as “Made in Indonesia.”

Applying glue to a roll of paper and cutting it up to make sticky notes7

No, sticky notes that are made by taking a giant roll of paper that was manufactured in either China, Japan, or Indonesia, and then applying adhesive and cutting the paper up in Taiwan, will be tariffed based on the country of origin of the giant roll of paper.

De minimis exception

Alright, if you’ve gotten through all of that, you’re probably asking yourself, “OK, so this has been going on for a long time. The US has been leveraging tariffs and using this totally deranged definition of country of origin for over a hundred years. Why has this suddenly made my life so much harder?” The answer to this question relies on one last (I promise!) definition: the de minimis exception.

The de minimis exception was introduced in 1938 and means that imports under some value (previously $800) are not tariffed, because it’s not worth actually collecting them. For example, if a shipment is worth $50 and has a 10% tariff of $5, the actual cost of inspecting that shipment and collecting that money probably costs the government more than the $5 gained, and it slows down the whole shipping process. One practical side effect of the de minimis exception was that while large companies and importers would have teams, lawyers, and contractors dedicated to navigating their global supply chain, small businesses and individuals were largely unconcerned with the issue because nothing we bought exceeded the threshold. Prior to August 29, 2025, 92% of all shipments into the United States, around 4 million packages daily, were valued under $800.

In July, Congress passed H.R. 1,8 which, among other things, repealed the de minimis exception starting in 2027, and at the end of July, the President signed an Executive Order fast-tracking that repeal and ending the exception starting midnight August 29.9

What’s happening

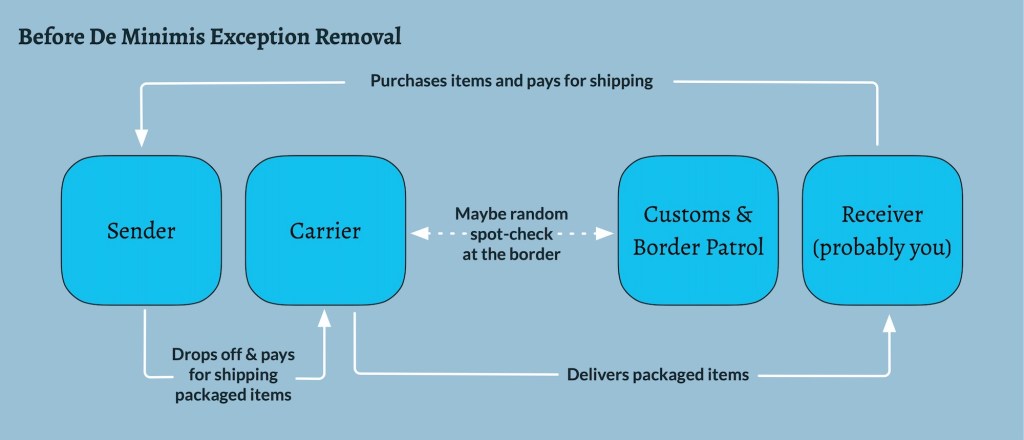

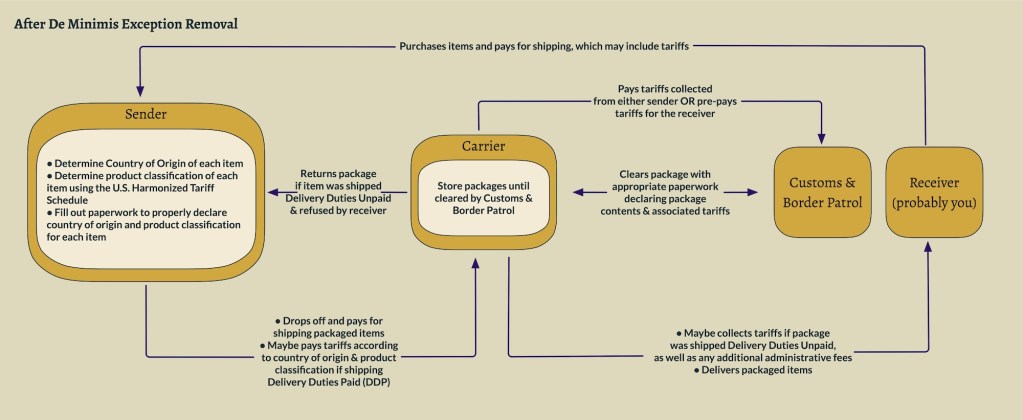

Actually implementing the repeal of the de minimis exception has created new responsibilities for everyone in your supply chain that previously didn’t exist. Before repealing the de minimis, the world was basically split into (1) people who care about tariffs and have huge teams to deal with them, and (2) everyone else who was blissfully unaware.10

The sender is now responsible for figuring out what tariffs need to be paid on the items they’re sending and deciding if they will pay those tariffs, or ask the receiver to pay those tariffs on delivery. This process includes (1) determining an item’s product classification using the United States Harmonized Tariff Schedule (which is a waking nightmare, go look for yourself)11, (2) determining an item’s country of origin to figure out what the applicable tariff is (which we have already established is confusing at best), and then (3) filling out the specific paperwork necessary to declare the items properly.

Once that’s done, the sender will need to take the package to a carrier (e.g. DHL, the national postal service, etc), who is now responsible for collecting the appropriate tariffs and paying them to the U.S. Customs and Border Patrol during the clearance process for the package. For the initial six months after the Executive Order went into effect, carriers are allowed to either (1) collect the appropriate tariff calculated based on the item’s product classification and country of origin, or (2) collect $80, $150, or $200 per item depending on the item’s country of origin. This is nominally to ease the transition process. It has in truth resulted in confusion and concern from senders who do not know how much they will be charged by carriers before they bring their packages in, and buyers who are concerned they will be hit with huge bills when receiving their purchases.

Once packages arrive in the U.S., Customs and Border Patrol must now inspect the over 4 million packages a day that arrive in the U.S. that previously were not subject to tariffs, verify the packages’ paperwork, and receive the collected money from the carrier. It will not surprise you to hear that it appears that they have neither the personnel nor the technology to accomplish this new mission.

The person receiving the package (probably you!) will have to wait longer for the package to arrive, since it needs to go through customs. If the sender sent the package without paying the tariffs, it will be up to the receiver to pay those tariffs to the carrier on delivery of the package. The carrier will pre-pay those tariffs to Customs and Border Patrol to get the package through the border, and then collect those fees afterwards from the receiver. They will probably also add a fee of some sort onto the tariffs to cover the financial risk they take on from that process because if the receiver refuses the package and will not pay the fee, the carrier cannot receive a refund on the tariffs they already paid from the government. If they do then try to return the package to the original sender, they may request that the sender reimburse them for the fees they paid to the U.S. government before they return the package. I have seen at least one story of a sender being unable to pay the surprise thousands of dollars fee for returned merchandise, and the items being disposed of by the carrier.

OK, so that’s a lot of change. As noted at the beginning of this post (we’re finally back!), you’ve probably seen a lot of banners on websites saying they can’t ship to the U.S. anymore, or you’ve ordered something and now the tracking status says it’s “stuck in customs,” or sometimes you just have no idea what’s going on. So what’s going on?

Initially, a lot of international postal services suspended shipping to the U.S. while they figured out how to handle these new requirements. Many of them have since resumed shipping, although I couldn’t find a comprehensive list of who is and isn’t. This is probably because the situation continues to change pretty quickly. There’s also been a slow down at the border of packages making it through customs. Carriers’ tracking systems may not take into account these changes, which makes it harder to get information from them about where a package is.

Packages that are not cleared by customs will likely be destroyed by the carrier. UPS has reported that they have so many packages in their warehouses that they cannot store all of them, and have had to begin destroying them12. Before the removal of the de minimis exception, the packages would often be returned to the sender, but with the current system being overwhelmed, that does not seem to be possible anymore.

So what’s a small business (or individual) to do?

Regardless of your politics or policy beliefs around tariffs, one thing is always true (and commonly missed by politicians): implementation is policy, and implementation is best when it’s easy to understand and follow.

The rollout of tariffs over the past year has been confusing and unpredictable, and the burden of that confusion has unfairly fallen on individuals and small businesses. When tariffs are placed on foreign goods that don’t have domestic producers, people are left with no choice but to pay the inflated prices or go without. Whatever the goal on the policy level really is, the true impact has been counterproductive and unsustainable.

And meanwhile, while policymakers, politicians, and pundits (oh my!) debate the value of tariffs and try to make them real or not, what should you as a random person who buys things on the internet do?

First and foremost, you’ll need to start paying attention to where the things you want and need are coming from, and you should expect it to be harder to get things that are not made in the U.S. By harder, I specifically mean “more expensive” and “take longer.” You’ll need to plan ahead, be more flexible, and if you really need it, consider stockpiling. This is true even if you’re buying from a U.S. store, since their merchandise will also start to cost more and they’ll probably pass those costs on to you as the buyer. Many businesses that depend on goods that are made abroad stockpiled as much as possible before the tariffs kicked in, but those places have sold through a lot of that stockpiled inventory. This means that even things you might have managed to get easily recently may still go up in price or suddenly become more scarce.

If you run a small business (like an escape room!) that depends on things that are made abroad (LEDs? Random bits of hardware? Lumber?), you’ll want to build as much flexibility into your project plans, supply chains, and budgets as possible. If you really need an item quickly, sometimes paying extra for shipping can help you get it faster, because companies like DHL have historically dealt with the small number of individual packages that did exceed the de minimis threshold and thus have teams and systems in place for handling tariffs. If that small business you run sells goods, you should be ready to communicate potential delays to your customers and expect that your customer base will shift (more American and less international), thanks to retaliatory tariffs that many countries have placed on American goods. Maybe there’s even an opportunity for supplying goods that people previously bought from foreign companies (silver lining, anyone?)!

You’ll also want to do your best to understand what the product categories and their associated tariffs are for the things you buy. There are reports of Custom and Border Patrol agents giving wildly varying tariff estimates for the same shipment.13 A small business owner in the UK told me that they’ve had clients have to challenge the tariffs classifications of their orders (turns out copper and brass are not the same thing and do not have the same tariff!).

Right now, the tariff situation is changing rapidly, including the possibility of the Supreme Court deciding the current set of tariffs are unconstitutional and the government somehow refunding all of the money that’s been collected (although probably not to you and me, individual buyers). Even if that happens though, there are many tariffs that won’t be struck down, and more may be imposed. The best place to find information on the practical impact of tariffs will be on the websites of carriers like DHL, UPS, and FedEx, or for marketplaces like eBay or Etsy. There are also some trackers that are looking at the larger swings in tariff policy, including across litigation, government activity, and so on, but those will generally be more politically oriented. If you want to get really nerdy about the broader economic impact of the tariffs, I recommend looking at the Yale Budget Lab’s reports. (Full disclosure: I’m friends with their Executive Director. Also a huge fangirl.) If you want an eye-watering set of graphics on how complex this is, the Cato Institute has also been writing on this and has a 2025 year end summary that also talks about the overall impact on U.S. businesses of the tariffs: Welcome to Tariff Complexity Hell.

The one thing that pretty much everyone agrees on is that tariffs are here to stay, and the uncertainty isn’t going away anytime soon. So stay informed and be prepared for the long haul, because things are going to keep changing and that’s not going to stop any time soon.

If you choose to leave a comment on this piece or on social media, work-in the word “time” to show that you read the whole piece.

- House of Commons Library: US trade tariffs ↩︎

- Peterson Institute for International Economics: US-China Trade War Tariffs: An Up-to-Date Chart ↩︎

- CourtListener: Anheuser-Busch Brewing Ass’n v. United States. Because I am a child, I did giggle at “ass’n”. Also, wow, has Anheuser-Busch in its various legal forms been involved in a lot of lawsuits. ↩︎

- For more details and if you want the satisfaction of listening to other people lose their minds about this, I relied heavily on the Planet Money episode “What ‘Made in China’ actually means” as a resource. ↩︎

- CourtListener: United States v. Gibson-Thomsen Co. ↩︎

- CourtListener: Uniroyal, Inc. v. United States ↩︎

- U.S. Customs and Border Protection: Country of origin of Sticky Notes ↩︎

- Wikipedia: One Big Beautiful Bill Act ↩︎

- White House: Suspending Duty-Free De Minimis Treatment for All Countries ↩︎

- And 3, trivia nerds who love facts like action figures being legally distinct from dolls for tariff reasons, and courts ruling that the X-Men are in fact “nonhuman.” ↩︎

- https://hts.usitc.gov/. This is one of the wildest documents I have ever seen, and I sometimes read legislation for fun. There’s a training module to help you figure out how to use it, and it takes a cheery tone, but this is clearly not designed for a normal human to navigate. ↩︎

- UPS is ‘disposing of’ U.S.-bound packages over customs paperwork problems ↩︎

- https://x.com/scottlincicome/status/1965860701303705689 ↩︎

![The Escape Ventures – Cornstalkers: Lost In The Maize [Review]](https://roomescapeartist.com/wp-content/uploads/2026/02/the-escape-ventures-cornstalkers-lost-in-the-maize-1.jpg)

![Mothman Themed House AirBnB Escape Room [Review]](https://roomescapeartist.com/wp-content/uploads/2026/02/airbnb-mothman-house-2.jpg)

![The Escape Game – Legend of the Yeti [Review]](https://roomescapeartist.com/wp-content/uploads/2026/01/legend-of-the-yeti-legend-of-the-yeti-3.jpg)

![Studio Escape – Madame LeClaire and the Seance of Death [Reaction]](https://roomescapeartist.com/wp-content/uploads/2026/01/madame-leclaire-madame-leclaire.jpg)

Leave a Reply